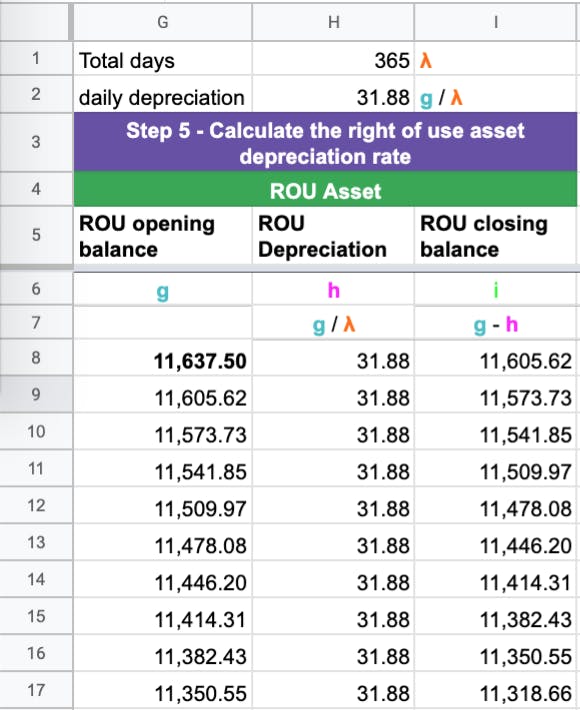

Ifrs 16 depreciation calculation

Virtually every company uses rentals. Depreciation is a term used with reference to property plant and equipment PPE whereas amortisation is used with reference to intangible assets.

Lease Accounting Ifrs 16 Excel Template 365 Financial Analyst

Among these are the.

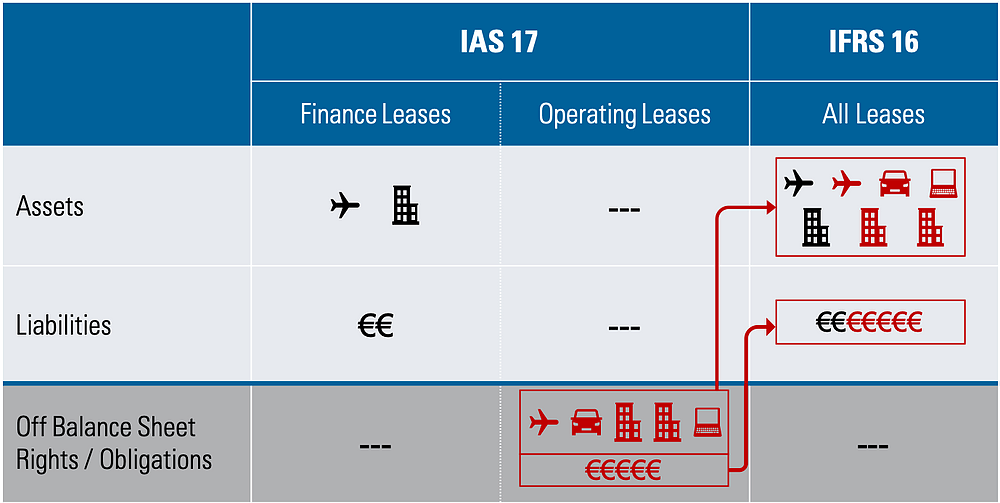

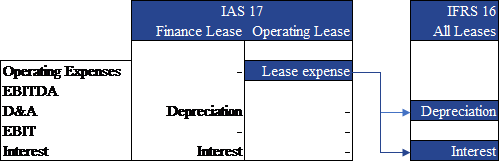

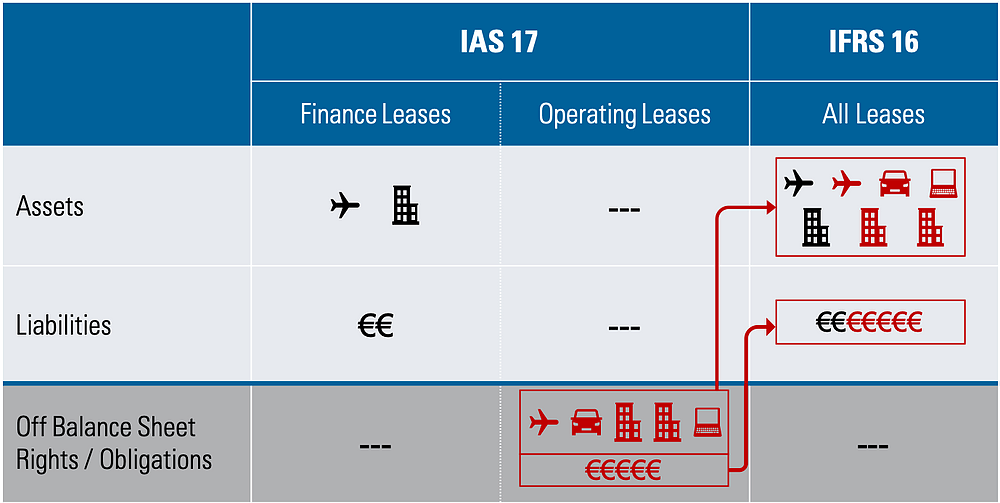

. The 5-step lease calculations model. The introduction of IFRS 16 will lead to an increase in leased assets and financial liabilities on the balance sheet of the lessee while Earnings before Interest Tax Depreciation and Amortisation. Depreciation by class of underlying asset.

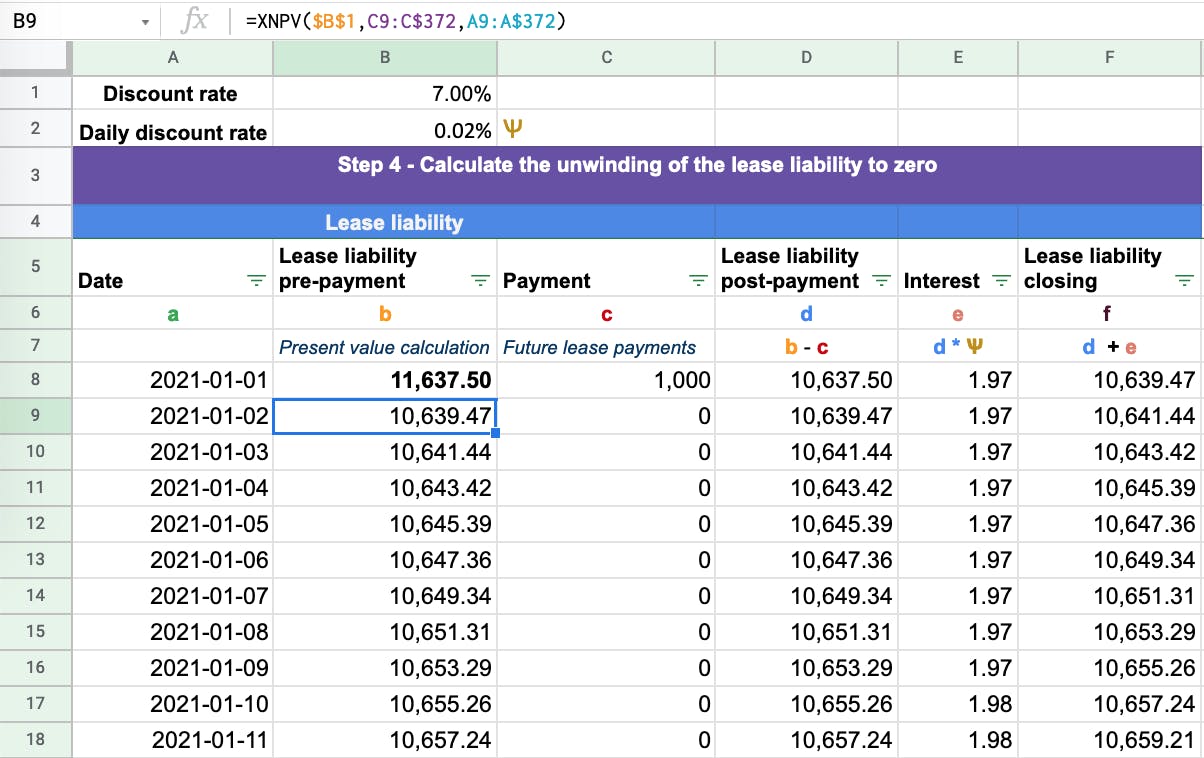

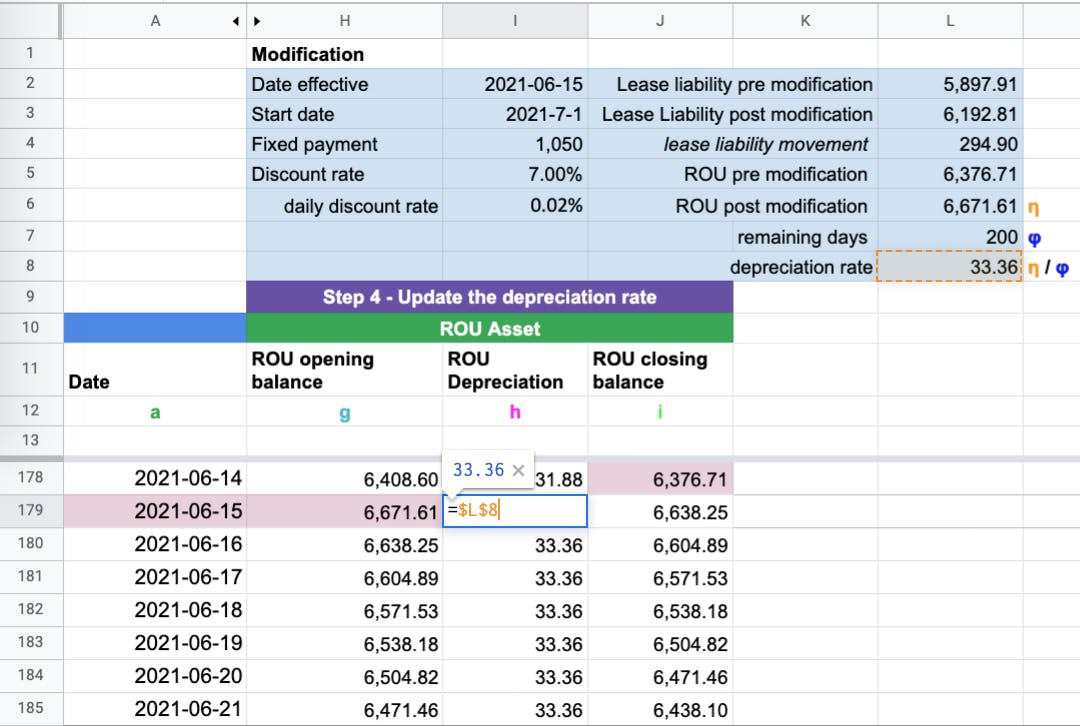

The IASB has published IFRS 16 the new leases standard. A change in accounting such as the introduction of IFRS 16 does not in itself change underlying economics. This is 4999750 on a quarterly basis but the first two months are free so the first lease term payment.

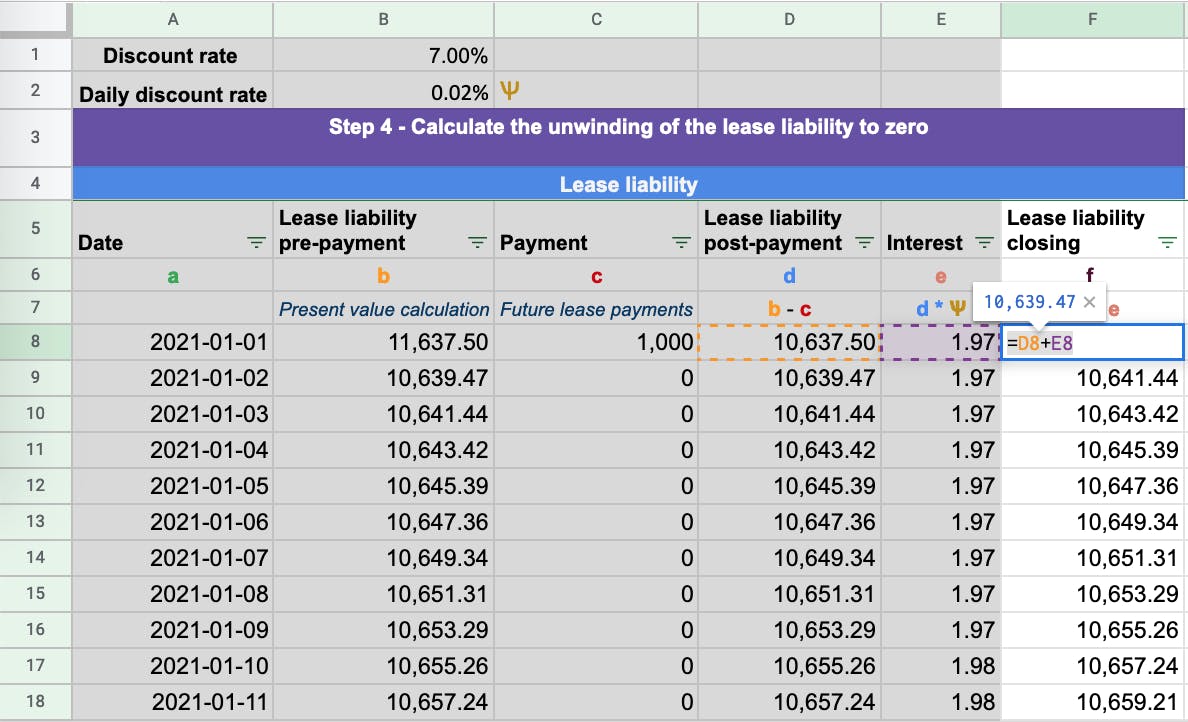

The company has rented an office with 5 years and the payment 120000 is at the end of each year. While the method to calculate the right-of-use asset according to IFRS 16 seems. The following amortization table shows the initial calculation of the lease liability using a payment of 20000 per year and an interest rate of 9.

Depreciation methods used in IFRS. IFRS 16 defines a lease as A contract or part of a contract that conveys the right to use an asset for a period of time in exchange for consideration. Rated The 1 Accounting Solution.

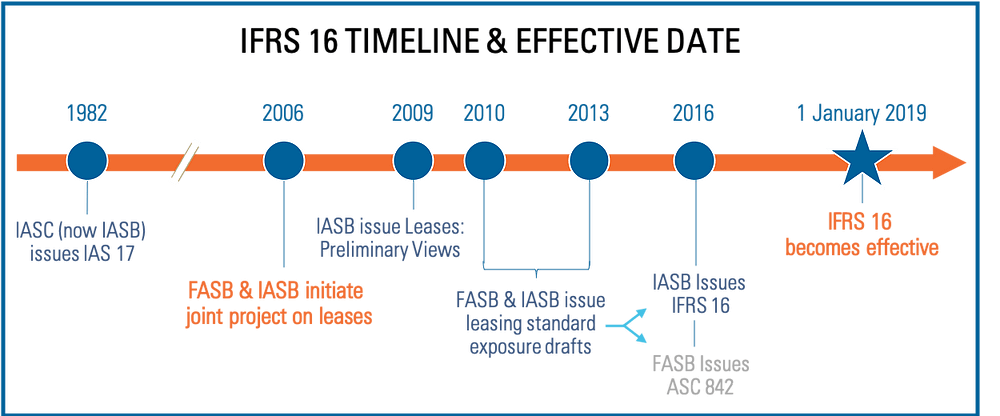

It comes into effect on 1 January 2019. Under paragraph 29 of IFRS. It follows that equity values derived from DCF models should.

Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. First adoption of IFRS 16 with an existing operating lease. In order for such a.

IFRS 16 dealing with the identification of leases. In IAS 16 specifically in paragraph 62 the depreciation methods IFRS in force to date are set out. Ad QuickBooks Financial Software For Businesses.

The objective of this amendment was to clarify the requirements for the revaluation method in IAS 16 Property Plant and Equipment and IAS 38 Intangible Assets to. Or leasing as a means to obtain access to assets. Illustration of application of amortised cost and effective interest method.

Identification of a lease contract. Revision of cash flows in amortised cost calculation. Convenient checklists for IFRS 16s presentation and disclosure requirements separately for lessees and lessors.

Step 2 Lease term. The annual lease term is 199990. Calculations IFRS 16 Leases.

Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. Re-estimation of cash flows in floating-rate. Get QuickBooks - Top-Rated Online Accounting Software For Businesses.

IFRS 9 excel examples. The IFRS Foundation is a not-for-profit public interest organisation established to develop high-quality understandable enforceable and globally accepted accounting and. Getting a helping hand with your lease accounting.

Lease Options to Extend or Terminate. IFRS 16 assets. And a brief.

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

The Simple Guide To Ifrs 16 What You Need To Know

An Overview Of Ifrs 16

Ifrs 16 Cortell Intelligent Business Solutions

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement

The Ultimate Guide To Accounting Under The Ifrs 16 Standard Occupier

Ifrs 16 Leasing Wikibanks

Ifrs 16 Leases The Impact On Business Valuations Accountancy Age

An Overview Of Ifrs 16

Example Lease Accounting Under Ifrs 16 Youtube

Simple Income Statement Template Beautiful The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement

Ifrs 16 Leases Calculation Template

Ifrs 16 Leases Summary Example Entries And Disclosures

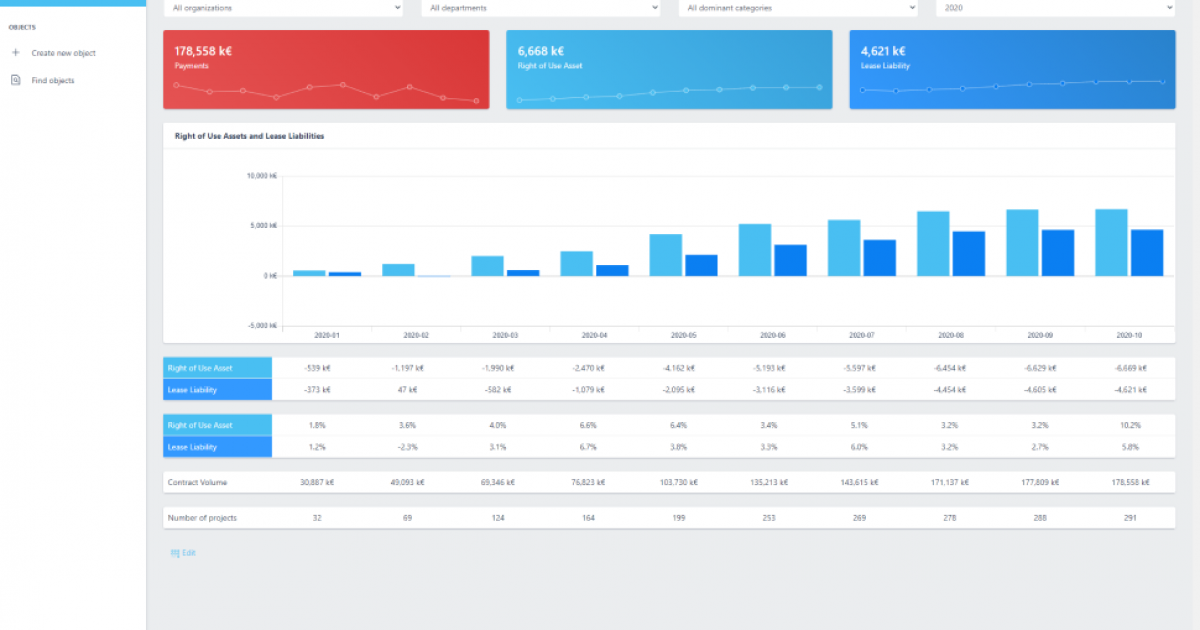

Lease Accounting Software For Ifrs 16 Asc 842

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16